|

|||

|

|

|

|

|

|---|---|---|

|

|

|

|

|

|

|

|

|

|

Understanding Mortgage Rates in Georgia Today: Navigating Your OptionsIn the current real estate landscape, particularly in Georgia, understanding mortgage rates has become more crucial than ever for prospective homeowners and seasoned investors alike. With a plethora of financial institutions offering varying rates, the challenge is not just finding the lowest rate, but also securing terms that align with one's financial goals and circumstances. Today, Georgia's mortgage scene is characterized by both traditional fixed-rate mortgages and more flexible adjustable-rate options, each with their distinct advantages and considerations. For those entering the market, it's essential to consider not just the interest rate, but also the associated fees, the duration of the loan, and how these factors play into your long-term financial plan. Fixed-rate mortgages provide stability with unchanging interest rates over the life of the loan, which is particularly appealing in an environment where rates might fluctuate. Conversely, adjustable-rate mortgages (ARMs) often start with lower interest rates, which can be enticing, but come with the risk of rising rates after the initial fixed period.

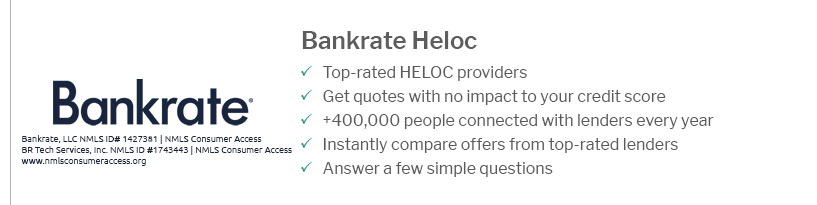

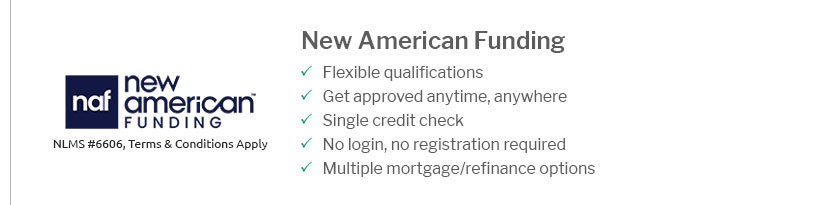

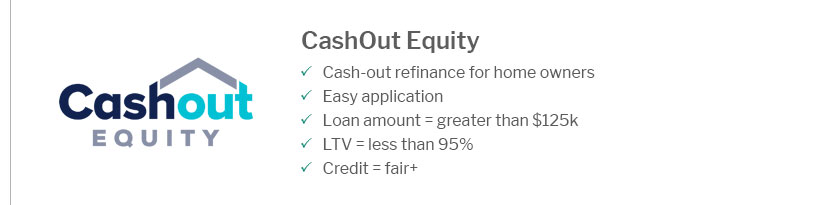

Ultimately, securing the best mortgage rate in Georgia today requires a blend of market awareness, personal financial health, and strategic decision-making. By taking the time to explore your options and understand the implications of each, you can make an informed decision that supports your journey toward homeownership. https://www.zillow.com/mortgage-rates/ga/

Compare today's mortgage rates in Georgia. Answer a few questions about your loan preferences to compare mortgage rates from multiple lenders in Georgia. https://www.nerdwallet.com/mortgages/mortgage-rates/georgia

Today's mortgage rates in Georgia are 6.840% for a 30-year fixed, 5.935% for a 15-year fixed, and 7.340% for a 5-year adjustable-rate mortgage ( ... https://www.bankrate.com/mortgages/mortgage-rates/georgia/

As of Friday, March 28, 2025, current mortgage interest rates in Georgia are 6.13% for a 30-year fixed mortgage and 5.42% for a 15-year fixed mortgage. In line ...

|

|---|